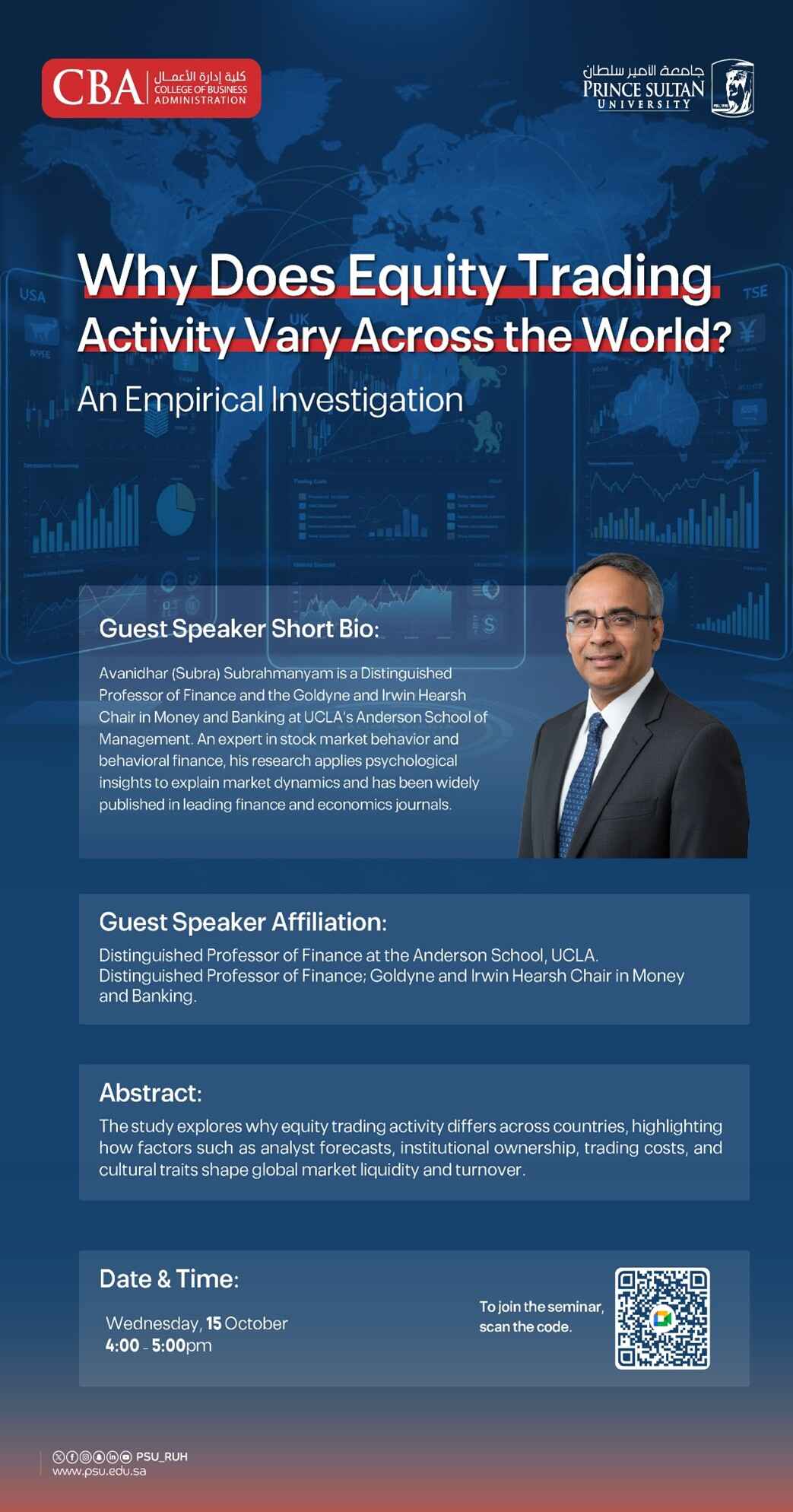

The

Department of Finance at the College of Business Administration (CBA)

successfully hosted the FERL Monthly Research Seminar featuring Professor

Avanidhar (Subra) Subrahmanyam, Distinguished Professor of Finance, Goldyne and

Irwin Hearsh Chair in Money and Banking, and Finance Area Chair at the UCLA

Anderson School of Management, USA.

Professor

Subrahmanyam, a world-renowned scholar in the fields of financial markets,

behavioral finance, and market microstructure, presented a stimulating research

seminar titled:

“Why Does Equity Trading Activity Vary Across the

World? An Empirical Investigation.”

In his

presentation, Professor Subrahmanyam explored why trading activity in equity

markets differs significantly across countries. Drawing on a rich cross-country

dataset, his research identified the main determinants of trading

activity—highlighting the role of analysts’ forecast divergence, institutional

ownership, and trading costs as key economic factors influencing market

liquidity and turnover.

He also

discussed how behavioral and cultural characteristics, such as ambiguity

aversion, risk tolerance, and gambling propensity, contribute to differences in

trading intensity between markets. The study further revealed that turnover

tends to be lower in populations with a higher proportion of women and

dependents, while higher financial development is associated with more active

trading.

The

seminar offered deep insights into the intersection of investor psychology,

cultural norms, and financial market efficiency, helping participants

understand how social and economic environments shape global trading patterns.

Faculty members, graduate students, and researchers engaged in a vibrant

discussion, raising thought-provoking questions about market behavior,

liquidity, and information efficiency in emerging economies.

Professor

Subrahmanyam’s presentation reflected his long-standing academic excellence and

contribution to finance research. He is the founding editor of the Journal

of Financial Markets and has received multiple awards, including the Smith

Breeden Prize and the Fama-DFA Prize for best papers in leading finance

journals.

The FERL

seminar continues to provide an engaging platform for faculty and students to

connect with leading scholars and exchange ideas on current research trends in

finance and economics.

🔗 Access the full paper: SSRN

Link