Architecture Department Invites the students to join the Meeting With The Chairperson , Dr.Eman Abowardah, and be part of the yearly rich discussion about the students inquiries , suggestions and ...

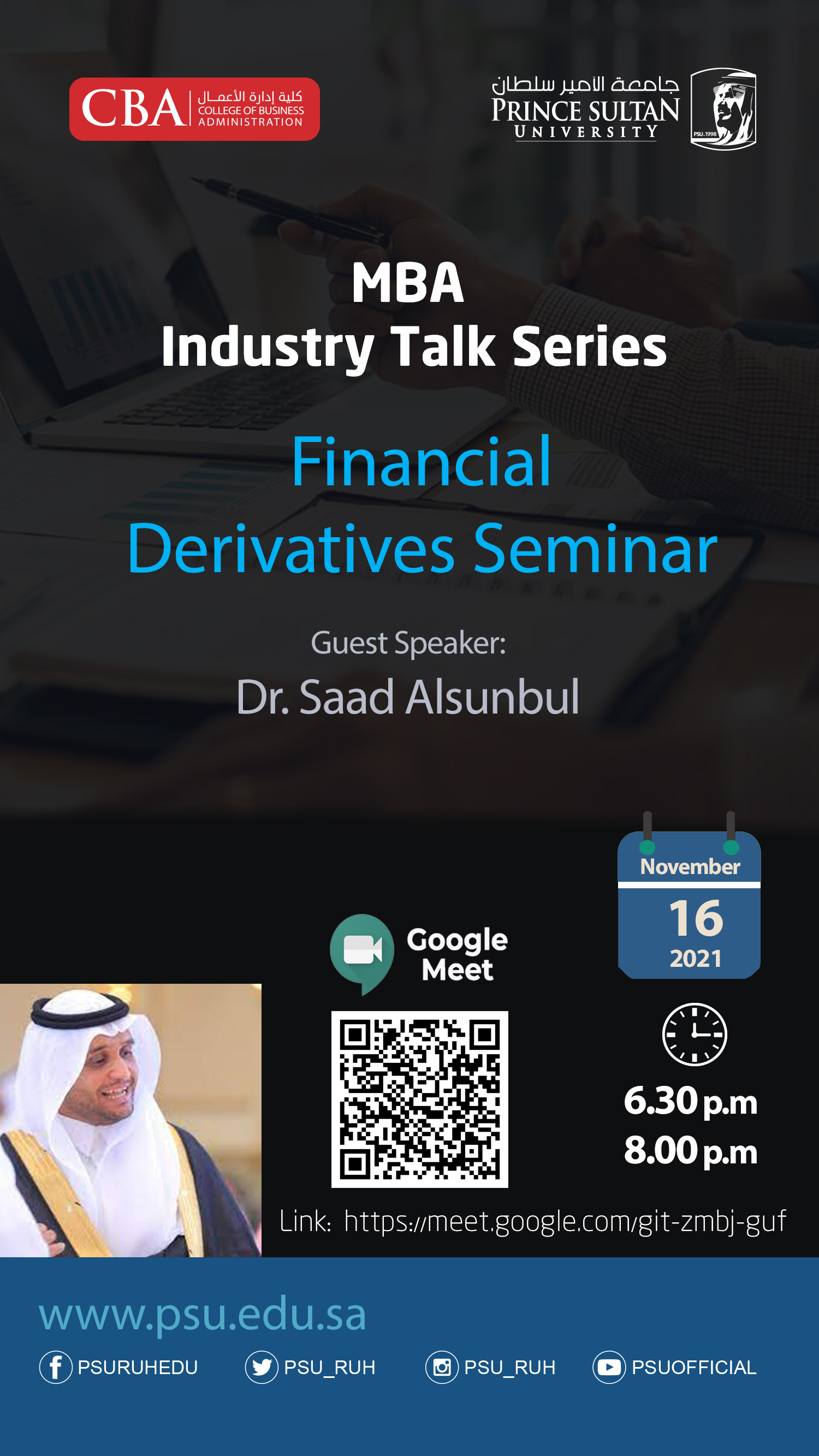

MBA Industry Talk Session: Financial Derivatives Seminar

Event details

MBA Industry Talk Session: Financial Derivatives Seminar

On Tuesday, November 16, 2021, the MBA Program/ Female section hosted yet another

session of its Industry Talk series featuring Dr. Saad Alsunbul, an Assistant Professor and the

Director of the E-MBA Program at Alyamamah University in Riyadh.

Dr. Alsunbul delivered an informative webinar on the use of financial derivative instruments

in financial markets both internationally and locally. He discussed the nature of financial

derivatives, their four different types and the main four goals they serve, hedging, speculation,

changing the nature of a liability, and changing the nature of an investment. Each single type

of derivative received special attention from our guest speaker, highlighting the major

differences in structure, size, platform and goal of each. Future contract for instance, are

agreements to buy or sell an asset at a certain time in the future for a certain price known as the

future price; while the spot contract deals with buying or selling the asset immediately. Next

on the agenda were the forward contracts, OTC agreements to buy or sell an asset at a certain

time in the future for a certain price known as forward price. A detailed comparison between

futures and forwards was also covered where MBA students were able to grasp the major

differences between the two highly similar derivative channels. Options were discussed next,

highlighting the two different types, puts versus calls, in addition to the American versus

European designation. The platforms on which options are traded were also covered; organized

exchanges and over-the counter markets. Finally, swaps were also explored; they are

agreements between two companies to exchange cash flows at specified future times according

to certain specified rule. Five types of swaps were explained: Interest rate swaps, currency

swaps, equity swaps, commodity swaps, and variance swaps. Each single type of derivatives

was carefully explained, listing its exclusive features and the purpose it serves.

A plethora of numerical examples for illustration purposes were also provided throughout the

webinar, where Dr. Alsunbul kept an interactive environment by involving the students in

solving the problems and answering the questions. The session was wrapped up by discussing

the current situation of the derivatives market in Saudi Arabia and the future of derivatives in

the kingdom.

MBA students were exposed to the novel field of financial derivatives and their rising

popularity as new promising financial mediums to hedge against risk and enable market

participants to use them to their benefits. The students took the floor to ask questions with the

guest speaker further elaborating on the subject matter.

The session was organized by MBA instructor, Dr. Rhada Boujlil.